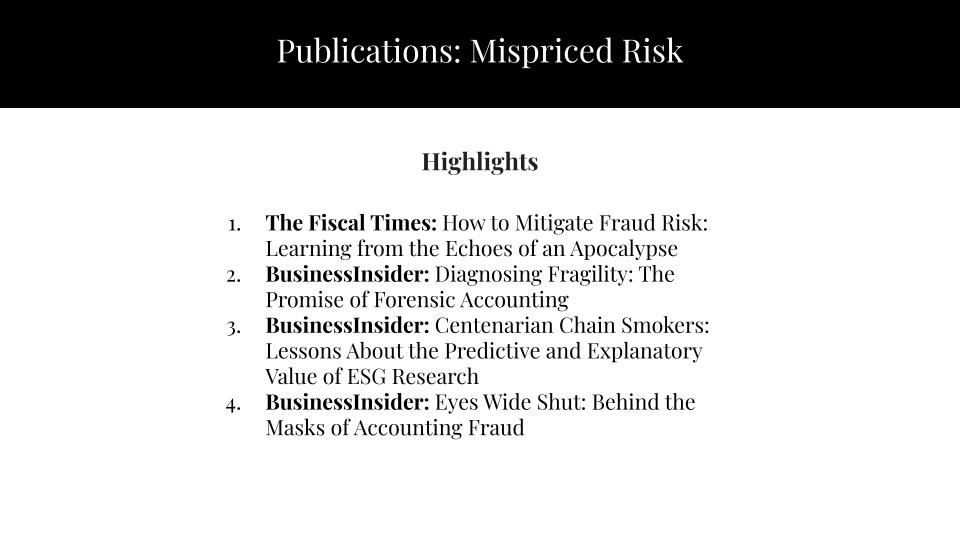

Below is a sample of published work related to mispriced risk.

How to Mitigate Fraud Risk: Learning from the Echoes of an Apocalypse

Published in The Fiscal Times, March 11, 2014

Six years ago this week — on March 10, 2008 — the collapse of Bear Stearns served as a grand prelude to the full-blown financial crisis that erupted a few months later. Fittingly, almost as a cosmic bow to this anniversary, a new revelation of fraud last week provided another reminder of how little our markets have changed to reduce the risk of similar implosions.

Diagnosing Fragility: The Promise of Forensic Accounting

By James A. Kaplan and Lev Janashvili - BusinessInsider, November 19, 2012

First, modern capital markets mask fragility (i.e., risk) with remarkable efficiency. They render naïve the lingering assumption that reported financial results faithfully reflect economic realities. In the increasingly complex, mechanized, technology-driven, inconsistently regulated markets, risk detection requires much more probing scrutiny, and failure to detect risk exacts a much higher price.

Aggressive accounting remains rampant – often neglected by resource-challenged regulators, enabled by bureaucratic standard-setters, exploited by corporate executives operating under perverse incentives. Ironically, this status quo often aligns with current securities law and SRO regulations. So far, we have not seen a sufficiently potent catalyst for change. For investors, insurers and anyone exposed to issuer risk, the conclusion is clear: buyer beware.

Centenarian Chain Smokers: Lessons About the Predictive and Explanatory Value of ESG Research

Published in BusinessInsider | February 13, 2012

If you watch director Mark Wexler’s How to Live Forever, you’ll see that a chain-smoking, beer-drinking centenarian makes a great character in a documentary film. But this biological oddity hardly qualifies as a role model for people who want to live long and healthy lives. Indeed, some studies have found that a surprising number of centenarians smoke, drink and live dangerously. Yet, most scientists and laymen would agree that they can best extend the years of their lives (and, yes, the life in their years) by not smoking and not drinking. The same logic applies to the integration of environmental, social, governance (ESG) and forensic accounting research into the analysis of investment risk.

Eyes Wide Shut: Behind the Masks of Accounting Fraud

Published in BusinessInsider | November 26, 2012

Just a day after we published GMI Ratings’ first “Black Swan Risk List”, the biggest accounting scandal in recent memory burst into national news, conforming to our prognosis with uncanny timing. Hewlett-Packard, a prominent member of our risk list with an ESG score of ‘F’ and a forensic accounting risk rating (AGR®) in the second percentile, announced a massive write-down related to its acquisition of Autonomy.

BP: Up Or Down? Investors Speak

Self-Published | June 24, 2010

We conducted this online survey to gauge the global financial community’s perceptions of the Deepwater Horizon crisis, its genesis and repercussions. We received 92 responses: 89 from investors and 3 from sell-side analysts. 74% of the respondents were based in North America, 23% were based in Europe and 3% were based elsewhere.

To receive new career-related publications by email, become a free subscriber.